China’s Deep Seeking Strategy and Its Impact on U.S. Markets in 2025

China’s Deep Seeking shook in U.S. Markets in 2025

In 2025, China’s deep-seeking strategies disrupted U.S. financial markets, sending shockwaves through global trade and investment systems. With China being a major player in the world economy, its decisions have a profound effect on countries like the U.S. In this article, we’ll break down the numbers and look at how China’s actions affected U.S. markets, from stock market declines to shifts in currency values.

China’s Economic Power

China’s growing economic influence cannot be overstated. As the second-largest economy in the world, it holds significant sway in global trade. China’s GDP exceeds $17 trillion, and it owns over $1 trillion in U.S. Treasury bonds, making it one of the most powerful foreign entities affecting U.S. finances. Any significant policy shift or economic strategy, like deep seeking, tends to stir up markets across the world.

Understanding Deep Seeking

In 2025, China’s “deep seeking” refers to actions aimed at restructuring its economy, reducing dependence on external trade, and strengthening its position in the global financial system. These tactics include currency manipulation, trade policy changes, and increasing foreign investments. The ultimate goal is to shift China’s economic balance, which inevitably affects global economies, especially the U.S.

Impact on the Stock Market

One of the first and most noticeable impacts of China’s deep-seeking strategies was felt on U.S. stock markets. Major indices such as the S&P 500 and the Dow Jones Industrial Average experienced sharp declines. For instance, in early 2025, the S&P 500 saw a sudden drop of over 4%, erasing roughly $1.2 trillion in market value. This drop occurred as investors grew increasingly nervous about the uncertain impact of China’s economic moves on U.S. companies and the global market.

Trade Tensions and U.S. Companies

Trade tensions between China and the U.S. escalated, leading to increased tariffs and other restrictions on goods exchanged between the two countries. In 2025 alone, U.S. companies reported a loss of over $75 billion due to Chinese tariffs. Industries such as agriculture, technology, and automotive were hit hard. For example, U.S. tech companies like Apple and Boeing saw a significant reduction in their profits due to decreased demand from Chinese consumers.

Currency Manipulation and U.S. Dollar

Another tactic in China’s deep-seeking strategy was currency manipulation. By devaluing the yuan, China made its exports more competitive, which caused the value of the U.S. dollar to fluctuate. In 2025, the yuan weakened to its lowest level in more than a decade, pushing the U.S. dollar down by 0.5%. As a result, the cost of imports from China increased, leading to higher inflation in the U.S., while American products became less competitive in international markets.

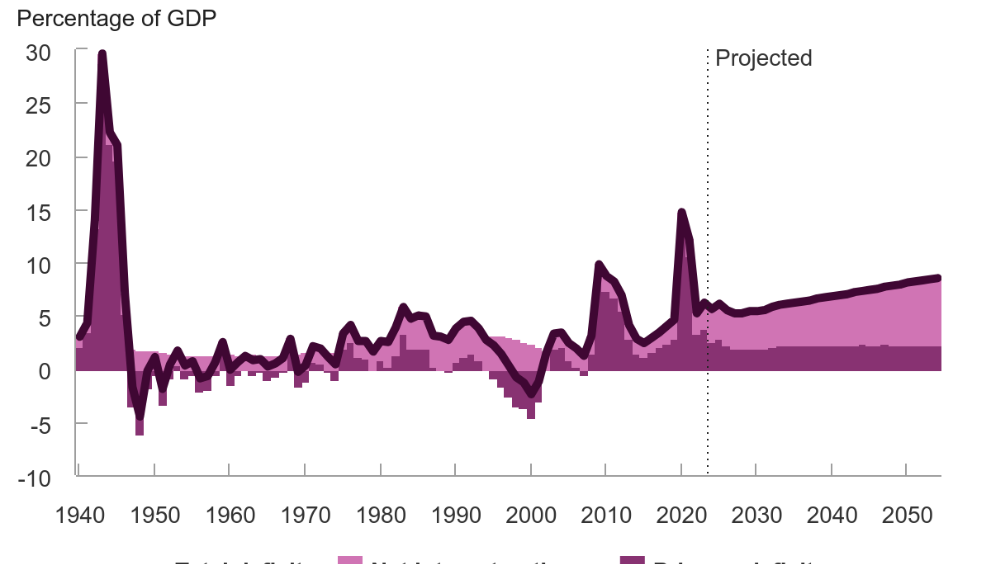

U.S. Treasury Yields and Bond Markets

China’s impact on U.S. Treasury bonds also created waves in the financial system. As China holds a substantial amount of U.S. debt, any shift in its bond holdings can affect U.S. bond yields. In 2025, rumors that China might sell off a portion of its U.S. Treasury bonds caused bond yields to spike, making it more expensive for the U.S. government to borrow money. As a result, interest rates on mortgages, car loans, and business loans also increased, adding pressure to U.S. consumers and businesses.

Investor Sentiment and Market Confidence

Investor sentiment took a hit as well. Surveys indicated that more than 65% of U.S. investors expressed concern about the prolonged U.S.-China trade conflict. The uncertainty surrounding China’s future actions caused many investors to pull their money out of U.S. stocks and bonds, seeking safer investments. This shift in sentiment further fueled market volatility.

Long-Term Effects on the U.S. Economy

The long-term implications of China’s deep-seeking actions remain uncertain. However, experts predict that the U.S. economy will likely face slower growth as trade relations with China become more strained. The International Monetary Fund (IMF) has already revised global growth projections downward, largely due to the ongoing trade war. In the U.S., businesses may face higher costs and lower profits, and consumers could see price increases on everyday goods.

Conclusion

China’s deep-seeking strategy in 2025 significantly shook U.S. markets, from stock market volatility to shifts in currency values and trade imbalances. The numbers clearly show that China’s economic maneuvers disrupted not only U.S. markets but also global financial systems. While the full impact of these changes is yet to be fully understood, it’s clear that China’s influence will continue to shape the U.S. economy in the years to come.Read more informative blogs

English

English